Recognising Gentrifying Neighbourhoods

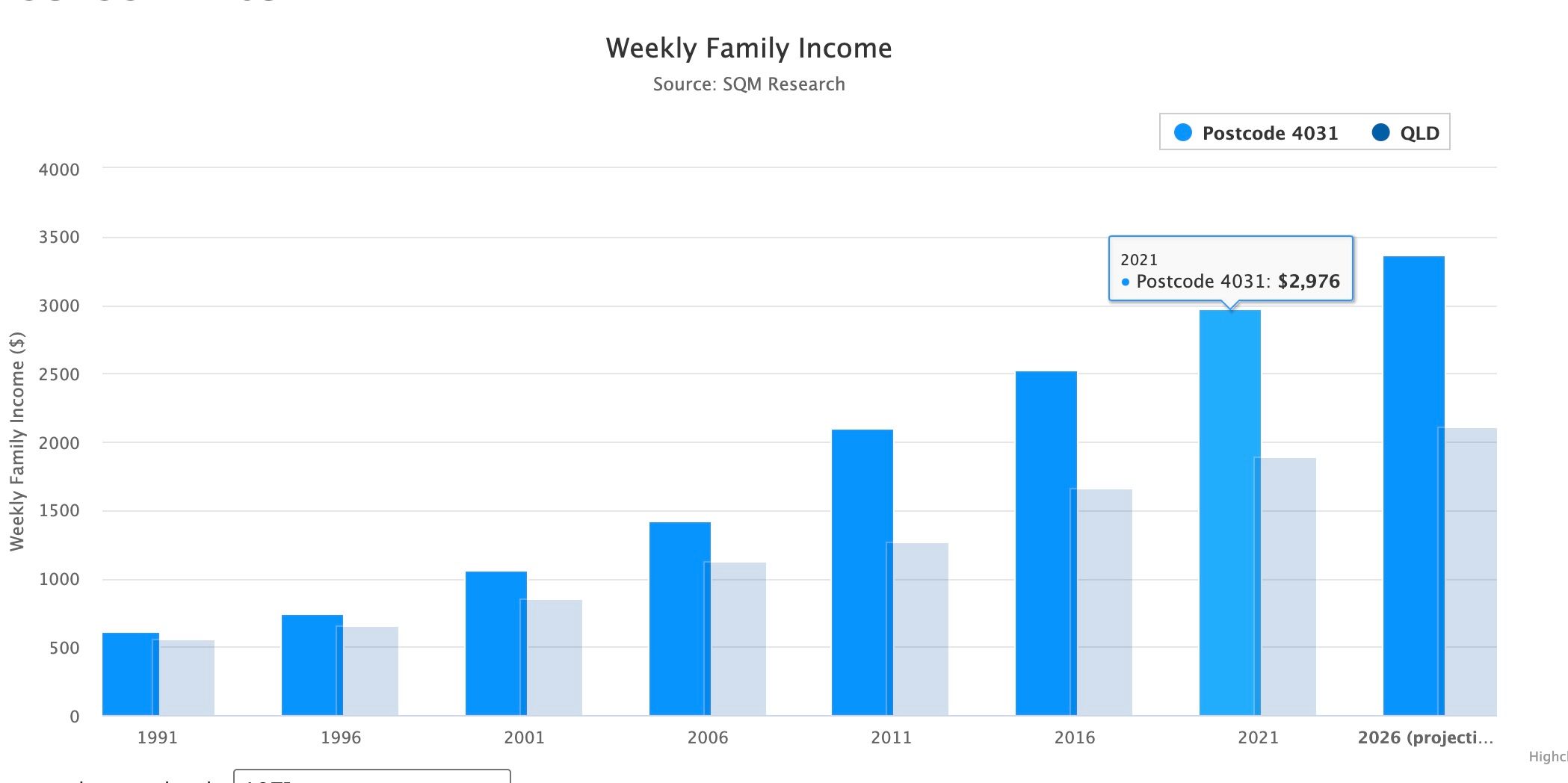

Rising wages are one of the clearest early indicators of a gentrifying area. As incomes increase, they signal a shifting demographic—typically from lower-income residents to more affluent professionals—bringing with them higher property demand, improved infrastructure, and lifestyle-focused development. By tracking wage growth alongside other data points, savvy investors and planners can identify suburbs on the cusp of transformation and capitalise before prices peak.

A gentrifying area is a neighbourhood that is undergoing gentrification—a process where a previously lower-income or working-class area experiences an influx of more affluent residents, investments, and development.

Key features of a gentrifying area include:

- Rising property values and rents

As wealthier people move in, demand increases, leading to higher prices for housing. - Changes in businesses and amenities

Older, often family-run shops may be replaced by cafes, boutique stores, and chain outlets that cater to new residents. - Upgrades in infrastructure and aesthetics

Improvements like new parks, better roads, and renovated buildings often accompany the change. - Demographic shift

There’s often a visible change in the racial, cultural, or socioeconomic makeup of the population. - Displacement of original residents

Long-term renters or lower-income homeowners may be forced out due to rising costs.

Investing early in a gentrifying area can be a smart strategy for several reasons—especially for savvy property investors or buyers looking for long-term capital growth. Here’s why:

1. Buy Low, Sell High

- Property prices are lowerbefore gentrification is widely recognised.

- As the area improves and demand increases, capital growth can be substantial.

2. Higher Capital Growth Potential

- Gentrification drives stronger-than-average appreciation due to rising desirability.

- Early investors can ride the full upswing as the suburb transforms.

3. Improved Rental Yields Over Time

- As more affluent residents move in, rental demand increases.